Art investment is one of the most popular alternative investments. There are many benefits to investing in art – for example, it’s a stable investment, it’s tangible, and can be a great way to diversify your portfolio while earning substantial returns. However, before you delve into the world of art investment, there are a few essentials that you need to know. That’s what we’ll be discussing in this blog post.

Read on for the top five things you need to know about art investment before spending your funds on investing in fine art.

1 – ART INVESTMENT CAN BE A GREAT WAY TO DIVERSIFY YOUR PORTFOLIO

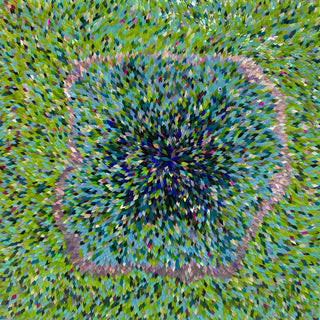

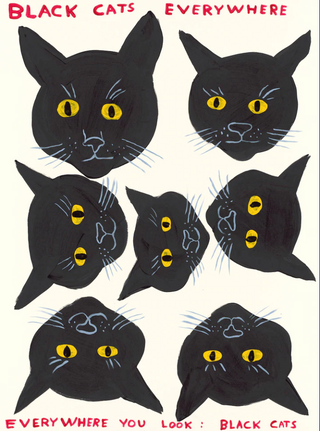

One of the best things about art as an asset class is that it is a great way to diversify your investment portfolio. Whether you choose to invest in digital art or traditional art mediums such as fine art or limited edition art prints, diversification is a fundamental aspect of any wealth management and investment strategy – and art investment is no exception. It may be tempting to focus on a specific art style or artist, but you should consider diversifying your art portfolio to reduce risks. Invest in different art styles and artists – this can be much safer than spending all your funds on one type of art. Spreading your investment across various styles and artists can ultimately help balance out potential losses.

Consider investing in different mediums such as paintings, sculptures, photography, and mixed media. It can also be beneficial to diversify your art investment by including works from various time periods and regions – this can add value and broaden the appeal of your portfolio.

2 – IT’S ALWAYS BEST TO WORK WITH AN ART ADVISOR

The art world can be difficult to navigate – even if you research thoroughly and learn as much as you can about the art market, the process can feel daunting without professional guidance.

Before consulting with an art advisor, take some time to learn about different artists, art movements, and historical periods. It can help to explore art galleries and exhibitions, and attend art fairs. This can also help you gain valuable connections with others in the art world. An art advisor is an expert in the art industry, highly knowledgeable in the world of art. When you work with an art advisor, you gain access to this useful information. An art advisor can help to determine the authenticity of a piece of art, judge its quality, and evaluate a work.

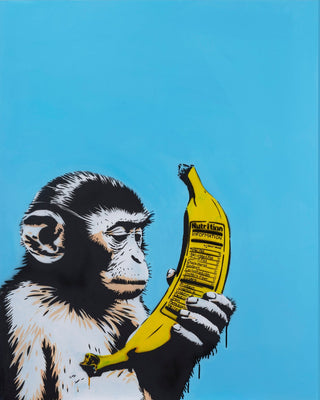

Ultimately, an art advisor can help to determine the right piece of art for your collection. For example, if you’re into street art, then they may help to source a Banksy art print. Likewise, if you’re into Pop Art, an art advisor may recommend a Warhol original.

3 – ART IS A STABLE INVESTMENT – BUT CONSIDER THE RISKS

There’s no denying that art is a stable investment – the art market has a history of withstanding economic uncertainty. It is resilient, and isn’t prone to drastic fluctuations. As an alternative investment, the art market isn’t as affected by economic instability as other markets such as stocks and shares/ the stock market.

With art investment, you not only maintain your current wealth, but can also make a profit in the long-term. However, as with any form of investment, there are risks to consider when buying art pieces. For example, art prices may fluctuate, and pieces may not increase in value as much as you hope. Be sure you’re aware of any potential pitfalls before investing in art – this can help you allocate your funds accordingly.

Blue-chip art is considered a more stable investment. This refers to artwork produced by reputable artists (blue-chip artists) with a history of success on the art market – when you invest in blue-chip art, it is considered far less risky. Investing in art from new, emerging artists can be high risk, but there may be chance of a higher return on investment if the artist rises in popularity – the artwork may drastically rise in value. Likewise, they don’t have the highest price tag, making it an affordable investment.

Ultimately, conducting thorough research and liaising with an art advisor can help to mitigate the risk associated with art investment.

4 – YOU SHOULD ALWAYS CONSIDER STORAGE AND INSURANCE

Art is delicate, and requires proper preservation. Consider how you’ll store the artwork – how are you going to maintain its value? There are several storage factors to consider such as humidity, temperature and exposure to light. These factors can all damage the original artwork, so ensure that you protect the artwork from these elements.

This is why many art investors consult with professional conservators. It’s equally as important to insure your artwork. The right insurance coverage can protect you from unforeseen events such as damage, loss or theft. You can find an insurance policy that’s tailored to your collection to ensure peace of mind and financial protection.

5 – ART IS A LONG-TERM INVESTMENT

Art is considered a long-term investment – you may not see profits from art investment for years to come. Art investment is great for patient investors – so always think in the long term. In fact, many art investors choose to leave valuable paintings to their descendants when planning their estate after retirement, passing them on as heirlooms.

Although art is generally a long-term investment, you should always plan ahead and consider your exit strategy. Consider your investment goals and timeframe. Are you looking for long-term appreciation or short-term gains? Understanding your exit strategy will help you make informed decisions about when and how to sell your works of art. You can sell art across a wide range of channels, including auction houses, galleries, private sales, and online platforms. Each method has its pros and cons, and it’s important to assess which option is the best choice for you.

Art auctions, for example, can offer high returns – however, they may come with substantial fees. Likewise, private sales and online platforms provide flexibility but may require more effort on your part. When planning your exit strategy or selling your art, you should always consider timing – timing is crucial. The art market can go through cycles of growth and decline, and choosing the right moment to sell can impact your investment returns. This is why it’s so important to consult with industry professionals and stay on top of trends.

INVEST IN ART TODAY

Art investment can be an incredibly rewarding and exciting venture, whether you decide to buy art at a fine art auction, through private sales, at an art fair, or through an art gallery. At Quantus Gallery, we can help you navigate the art market and find the best pieces of art on the secondary market to invest in. We have contemporary art you can invest in created by the likes of Banksy, Opake, Stony and many more. Explore our London art gallery today, or contact us to begin your art investment journey.