Investing in 2023 is a great way to secure your financial future. Whether you are new to the investment world or are an experienced investor, now is the best time to expand your knowledge.

As a new investor, you will gain the knowledge to kickstart your investment journey from this blog. If you’re a seasoned investor, you will learn why adding art to your portfolio can reduce the impact of losses. Let’s explore this topic together!

WHY IS INVESTING IMPORTANT?

When managing your finances, investing should not be an option. It’s a crucial element that can bring significant financial gains to your financial strategy. It is important to note that investing involves risk, including financial loss. This is why it is important to listen to professional advice.

Whether you’re a seasoned investor or a complete novice, having a complete understanding of the investment world is very important. Here are some reasons why investing should be a top priority:

Wealth Growth

Investing allows your money to work for you. Instead of keeping your savings, you can make them grow by investing. This is essentially allowing you to earn money with the money you already have.

Financial Security

Investing can help you achieve long-term financial goals. This can include buying a home, funding your child’s education, or retiring comfortably. It provides a way to build a financial safety net for yourself and your family.

Furthermore, having a certain amount of money tied up into investments also means that you cannot take it out freely to spend. This, in turn, forces you to save more.

Beat Inflation

Inflation means that your money is worth less as time passes. Investing can help your money grow faster than inflation, so it keeps its value. In most cases, with a strong portfolio, you will earn a profit from investing.

Mix Up Your Portfolio

Investing in different assets and sectors can spread risk and protect your portfolio from market fluctuations. A diversified portfolio can help you weather economic ups and downs.

Passive Income

Many investment decisions, such as dividend-paying stocks, rental properties, and bonds, can provide a steady stream of income. This can be particularly useful during retirement, when you are not working. Having multiple streams of income is more helpful for building wealth than relying on one full-time job alone.

DIFFERENT TYPES OF INVESTMENTS

There are many different investment opportunities that you must know about to make your portfolio strong. In this section, we will explore high-yield saving accounts, stock and shares, real estate, and starting an eCommerce business.

We will also touch upon an alternative investment that has become increasingly popular in recent years: art.

High-Yield Savings Accounts

One of the safest ways to invest is by collecting savings in a high-yield savings account. These accounts offer easy access to your funds and are usually FDIC-insured for protection within federal limits.

While they are generally safe, low-interest rates may pose an inflation risk. The real perk is the potential for higher interest rates compared to traditional banks, thanks to reduced overhead costs.

In a nutshell, high-yield online savings accounts offer easy access to your account and online security. It also gives you the chance to watch your money grow with competitive interest rates.

Stocks and Shares

Investing in stocks is a classic way to participate in the growth of businesses. You can consider investing in S&P 500 index funds, which offer diversified exposure to the U.S. stock market.

Investors know these funds for their stability and long-term growth potential. People often label them as ‘risk investments’ because the market can change at any given time.

Real Estate

There are many different ways that you can make money from real estate. You can buy properties in areas where their value goes up over time, also known as ‘appreciation’. When the value goes up, you can sell the property to make a profit.

You can also rent out the property and get a steady income from the rent. This, in theory, means that someone else is paying off the mortgage on your home.

Another way is to buy run-down properties, fix them up, and sell them for more money than you spent (renovation and resale). There is no right or wrong option when investing in real estate.

Some people may have a preferred method according to costs and effort input. However, all have proven to help you gain a profit if you are smart with your decisions.

START AN E-COMMERCE BUSINESS

Launching an e-commerce business can be an entrepreneurial investment opportunity. With the rise of online shopping, there’s a substantial market for various products and services. It requires dedication, research, and effective marketing strategies.

ART AS AN INVESTMENT

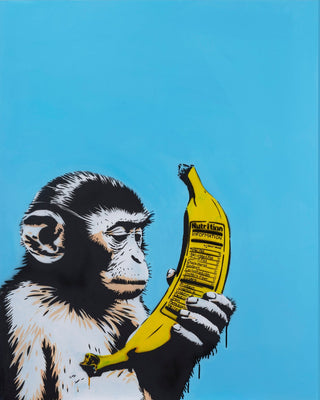

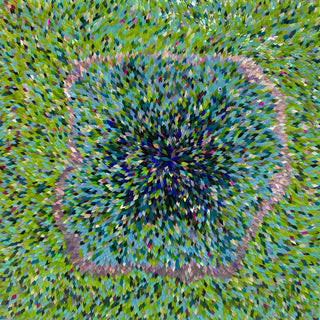

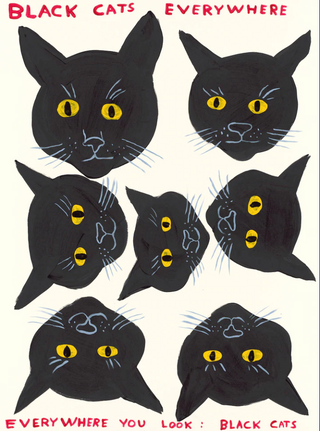

Art has been gaining recognition as a viable investment. Emerging artists often produce works that appreciate in value over time.

Investing in emerging artists also allows you to purchase artwork at a significantly lower price compared to established artists. The art market can provide substantial returns, making it an attractive choice for art enthusiasts and investors alike.

WHY IS IT IMPORTANT TO DIVERSIFY YOUR INVESTMENTS?

Mixing up your investments is crucial to managing risk and enhancing the potential for returns. By spreading your investments across different asset classes, such as stocks, bonds, real estate, and art, you reduce the impact of a poor-performing asset on your overall portfolio.

Investing in different areas can help you find a good balance between risk and reward. This helps to reduce the negative impacts of a changing investment market. As art rarely tends to decline in worth, you are at a higher risk of potential losses without having art in your portfolio mix. It adds a layer of safety to your investments.

QUANTUS IS HERE TO HELP

At Quantus, we specialise in art as an investment and have a wealth of investment advice to offer. We believe in the power of art to not only beautify your surroundings but also to grow in value over time. Our curated selection of emerging artists offers an opportunity to invest in unique and promising artwork.

By including art in your portfolio, you can start increasing the potential of your investments and reduce the impact of poor-performance assets. Not only this, but it allows you to own artwork that you are proud of while supporting emerging artists.

We understand that everybody has different budgets based on their individual circumstances. That’s why we aim to provide you with the most accurate knowledge to help you make intelligent investment decisions.

Call 020 8145 1000 today to speak with one of our friendly team members about starting your investment journey. You can also reach us by email at info@quantusgallery.com. We are excited to help you on this journey!