Art has been a powerful medium of human expression for centuries, captivating minds and touching hearts across cultures and generations. Beyond its intrinsic value, art has also emerged as a fascinating investment opportunity for those who seek to diversify their portfolios and explore alternative assets. In this blog, we will delve into the world of art as an investment, understanding its unique characteristics, the factors that drive its value, the potential risks and rewards, and how to navigate the art market with confidence.

THE HISTORY OF ART INVESTMENT

The idea of art as an investment is not a recent phenomenon. Throughout history, wealthy patrons, art connoisseurs, and collectors have recognised the potential of art to appreciate in value over time. Famous families and ultra-high-net-worth individuals like the Medici in Renaissance Italy and the Rothschilds in the 19th century amassed substantial art collections that not only reflected their wealth and status but also served as valuable investments.

In the modern era, art investment has become more accessible to a broader audience. With the rise of art galleries, auction houses, and online platforms, people from different walks of life can participate in the art market and potentially benefit from the appreciation of art values.

UNDERSTANDING ART AS AN ASSET CLASS

Before delving into the realm of art investment, it is crucial to comprehend the unique characteristics that set art apart from traditional financial assets:

Subjectivity

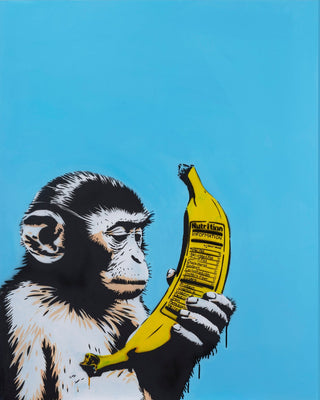

The value of art is subjective and influenced by individual tastes, cultural significance, and emotional connections. Unlike stocks and bonds, which have objective metrics such as earnings and interest rates, art’s worth can vary greatly from person to person. For example, some may hold contemporary art at a low value, but value Pop Art at the highest price tag.

Illiquidity

Art is considered an illiquid asset, meaning it may take time to find a suitable buyer and complete a sale. Unlike publicly traded stocks, which can be bought and sold quickly, selling art often requires patience and a deeper understanding of the market.

Tangibility

Art provides a tangible and aesthetic pleasure, allowing collectors to enjoy and display their investments in their homes or private spaces.

Diversification

Art offers diversification benefits to an investment portfolio. Its performance may not necessarily correlate with traditional financial markets, providing a potential hedge against market fluctuations.

FACTORS THAT CAN INFLUENCE THE VALUE OF ART

Several factors contribute to the value of a work of art. Understanding these factors when buying art can help you make informed decisions when acquiring art as an investment:

Artist Reputation

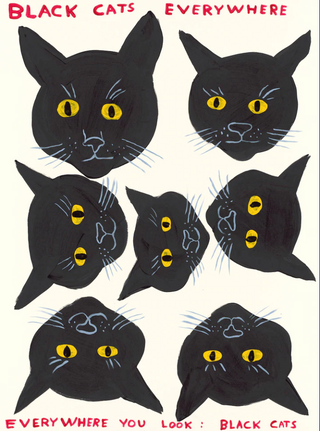

The reputation and recognition of the artist significantly impact the value of their artworks. Renowned artists with a strong track record of sales and critical acclaim (blue-chip artists) often command higher prices for their creations. Emerging artists may be a riskier investment, but there is a change of higher returns.

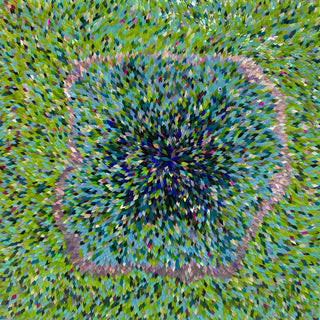

Artistic Significance

The historical and cultural significance of an artwork can elevate its value. Pieces of art from pivotal periods in art history or those representing a unique artistic vision can be highly sought after.

Provenance

The documented ownership history of an artwork, known as its provenance, can affect its value. Works with clear and illustrious provenance can be more desirable to collectors.

Medium and Condition

The medium in which the artwork is created, such as oil on canvas or sculpture, can influence its value. Additionally, the condition of the artwork is vital; well-preserved pieces are generally more valuable.

Demand and Scarcity

Like any market, supply and demand dynamics play a crucial role in art values. Artworks that are in high demand and limited supply are more likely to experience price appreciation.

Market Trends

The art market is subject to trends and fashions, which can influence the value of certain artists or art styles at a given time. We work with a variety of artists at Quantus Gallery, from up-and-coming artists to established blue-chip artists.

POTENTIAL RISKS AND REWARDS

As with any investment, whether it be real estate or stocks and shares, art investment comes with its own set of risks and rewards. However, if you conduct thorough research, the rewards outweigh the risks.

Rewards

First of all, fine art has historically demonstrated the potential for significant long-term appreciation, outperforming some traditional asset classes under certain market conditions. Likewise, art investment offers diversification benefits, as its performance is not closely tied to traditional financial markets, reducing the overall portfolio risk. Owning art can be a deeply enriching experience, providing emotional and aesthetic pleasure, and contributing to cultural preservation. Collecting art can be a gratifying pursuit in its own right, allowing art investors to build a collection that reflects their taste and passions.

Risks

The subjective nature of art valuation can lead to price volatility, and an artwork’s value may fluctuate over time. Likewise, the art market’s illiquidity means that selling an artwork may take time, and it may not be easy to find a buyer willing to pay the desired price. This makes art a great long-term investment opportunity.

Successful art investment demands a deep understanding of the art market and trends. However, this can be easily solved with the support and advice of art advisors or art specialists. It’s also important to note that the art market is susceptible to counterfeit works. However, if you exercise caution and conduct thorough due diligence, the risk hugely decreases.

NAVIGATING THE ART MARKET

Navigating the art market requires a combination of knowledge, due diligence, and patience. First of all, be sure to invest time in learning about art history, artistic styles, and prominent artists. It can be helpful to attend art exhibitions, visit museums, and read art-related literature to deepen your understanding.

To learn more about the art world and to explore different artworks, visit galleries and art fairs. Engage with galleries and attend art fairs to gain insights into the art market and discover emerging talents. Likewise, familiarise yourself with sales terms and conditions, including return policies and any additional fees that may apply.

It’s important to note that the art world can be difficult to navigate, which is why many work closely with professionals when investing in fine art. Seek advice from art advisors, appraisers, and specialists who can help you make informed decisions and avoid potential pitfalls. We recommend that you set a budget and try to stick to it. Determine how much you are willing to invest in art without compromising your overall financial goals.

If you’re a beginner to the world of art investment, consider starting with lower-priced artworks before moving on to more significant investments. When purchasing art, it can be helpful to explore online art platforms that offer a wide selection of artworks, providing access to various styles and price points.

ART INVESTMENT OPPORTUNITIES AT QUANTUS GALLERY

Art investment offers a captivating journey that combines passion, creativity, and potential financial rewards. As you embark on your art investment journey, remember that educating yourself, setting a budget, and conducting due diligence are essential elements for successful investing. Art’s intrinsic value and its potential to appreciate over time make it a unique and alluring asset class.

Whether you are an art enthusiast or a seasoned investor, understanding art as an investment opportunity can open doors to a world of cultural enrichment and financial potential. Begin your art investment journey today with Quantus Gallery. Whether you’re looking for pieces from emerging artists or established artists, limited edition prints or canvas pieces, we have it all.